Shipping has been an important human activity throughout history, particularly where prosperity depended primarily on international and interregional trade. According to the International Maritime Organisation (IMO) statistics in 2017, shipping has an essential contribution to the world economy since more than 90% of the world’s trade, in volume, is carried by sea. In a broader perspective, transportation has been called one of the four cornerstones of “globalization”, along with communications, international standardization, and trade liberalization.

According to the World Bank, the best four logistics performers are from the EU and out of the global top‐10, 7 of them are from the EU in 2016. Maintaining the current European world leadership in logistics is crucial for the European economy and citizens’ future. Furthermore, according to the Alliance for Logistics Innovations through Collaborations in Europe (Alice) in 2018, the EU is the globally largest exporter and biggest trader of goods and its competitiveness of industry sectors relies heavily on the performance of freight transport and logistics. It is estimated that a 10% to 30% improvement in efficiency in the EU logistics sector has the potential equal to € 100 – 300 billion cut in costs for the European industries with consequent reduction of 15% to 30% in CO2 emissions.

The slowed-down in economic growth of China and global trade have pushed the ports and logistics firms to develop their investments in new technologies and innovations of information and communications technology (ICT). The ports and logistics sector has already used new technologies to a certain extent but five innovations have recently gained uprising significant attention in this sector: automation, autonomous transport, big data, simulation and virtual reality, and Blockchain. (See Fig.1). In the next years port and logistics will encounter more substantive changes as automation becomes dominant and operations are directed in real time by a wide range of sensors and intelligent software.

Figure 1. Five ICT innovations with the highest impact on ports and logistics.

Source: Produced by Author

- Automation

Logistics automation and robotic operation is the application of computer software and automated machinery and equipment to enhance the efficiency of logistics operations. Typically this refers to operations within a warehouse or distribution centre, with broader tasks undertaken by supply chain management systems. According to Adam Robinson in 2013, There are six major benefits of applying Logistics Automation in transport management system:

-The decrease in Costly Errors

-Availability of Transportation Mode Choice and Real Time Freight Rates

-Increased Customer Service

-Access to Real Time Freight Data and Analysis

-Organizational Control

-Scalability and Speed

In recent years, there has been a steady rise in automation at European ports, and automated equipment, produced by firms such as Kalamar, are currently available for many terminal functions like ship-to-shore berthings, straddle-carrier ground transportation, the management of container stacks, and also trucks loading. A number of this automated equipment can run quite autonomously, while the other ones use remote operators in a safer and more comfortable place. Software and sensors are utilized widely for monitoring the practices, which results in an optimised smooth flow of goods through the port, with related savings in time, fuel/cost, and personnel.

- Autonomous transport (vehicles)

Development of autonomous means of transport, across land, air and sea, has recently gained substantial attention and have implications for ports and logistics firms. Already there are special autonomous trucks within ports to move containers. There are advantages of investing in driverless vehicles. Safer transport is at the main focus as research shows that up to 90% of road traffic accidents are originated from human errors by the drivers. Furthermore, autonomous systems always monitor and adapt to varying traffic and weather conditions, and doing all this with more speed, and safety than human drivers. It increases the efficiency of transport while lowering the environmental impacts due to less fuel consumption.

In the air section, the application of small drone copters used as package carriers, by companies like Amazon, is a big step in the last mile of the logistics chain. DHL and Google are also leading companies. In the maritime industry, the Rolls-Royce estimates a reduction of fuel consumption by up to 20%. As a result of the elimination of accommodation on a crewless vessel, overall operating expenses will be cut by around 40%. KONGSBERG is also developing autonomous/unmanned / self-driving ship control systems. Kongsberg projects have a focus on integrated sensor technology, and automated collision avoidance. Figure.2 shows some examples of autonomous vehicles across the medium of air, land and water.

Figure 2. Autonomous vehicles in operation

Source: Produced by Author

- The Big data

Today, the world is highly hyper-connected. The experience from successful Internet powerhouses like Google, Amazon, eBay, and Facebook leaves no doubt that information has become an essential element of competitive differentiation. Firms and companies in different industries have put their efforts to have accurate data-driven insight in order to achieve effective decision-making and successful businesses. Therefore, for companies, the purpose of handling a high volume of data at high speed is to capitalize an additional value from the bulk of data.

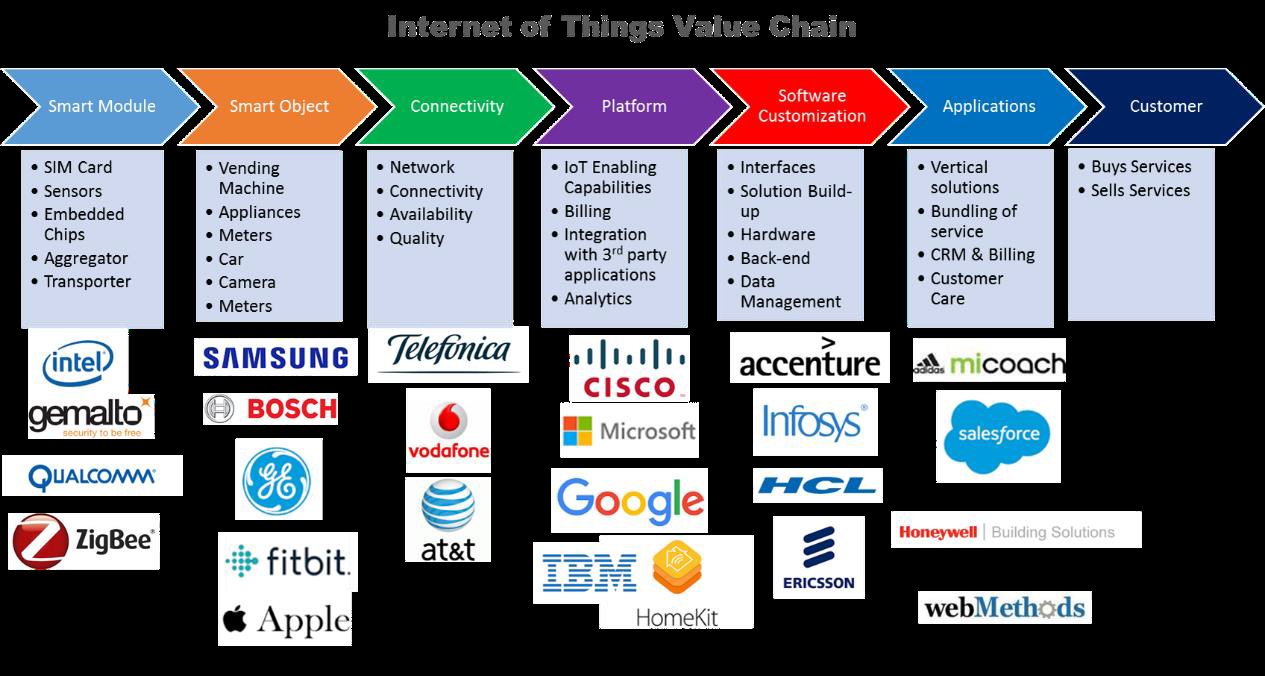

In logistics, the major part of this data is produced by the growing number of robots and automated equipment and processes. The recent advanced and cheap sensors allow the firms to track the goods and measure the activities. These sensors make the equipment of the ports and the cargo in a warehouse enable to be “connected and linked”, as part of a wider network of the Internet of Things (IoT). This is one of the most important aspects of the Big data. The IoT means the wide increasing range of physical objects, or “things”, that are linked to a network for sending and receiving data. in logistics, the examples could be the sensors that monitor a reefer containers’ temperature.

However, for a successful application of the IoT, an effective communications systems is to be established. This is more crucial for ports, where containers and equipment can be obstacles for signals. Similarly, at indoor places such as warehouses, Global Positioning Systems (GPS) usually is not used so that other technologies like RFIDs are needed. Network infrastructure at the ports needs to be adequate for the high bandwidth and use cybersecurity for the purpose of IoT applications.

Figure 3. Internet of Things value chain

Source: University of Antwerp,(2017)

Some ports in South East of Asia like Singapore have already leveraged big data techniques to create intelligent inspection systems. These smart systems review and assess the importers’ histories and background, regarding the cargo type, in order to identify those which are more suspected for inspection, to ensure a fast and smooth flow of the goods without impacting on the security objectives.

- Simulation and virtual reality

The availability of a wide range of big data applications will lead to opportunities for port operators, logistics firms, and service providers to take advantages of simulation software. In this respect, different port operations could be modelled to analyze operational flows, identify the possible barriers, and evaluate various scenarios of design and throughput. The simulation will play a more important role when the automated equipment and robotic machinery are used in port and logistics sector. This help understanding the impact of these technological developments as well as how to integrate them into terminal processes and operations.

For an efficient synchronization of port and logistics activities through simulation, a technology that will support a lot is virtual reality (VR). It assists via expansion of physical reality by adding layers of computer-generated information to the real environment, to support such operation simulations. In a port atmosphere, it can be achieved by visualizing enhanced feeds from infrastructure, port equipment, automated vehicles and various types of drones.

5.Blockchain

Marc Andreessen defined the Blockchain in simple words as “The practical consequence […is…] for the first time, a way for one Internet user to transfer a unique piece of digital property to another Internet user, such that the transfer is guaranteed to be safe and secure, everyone knows that the transfer has taken place, and nobody can challenge the legitimacy of the transfer. The consequences of this breakthrough are hard to overstate.”

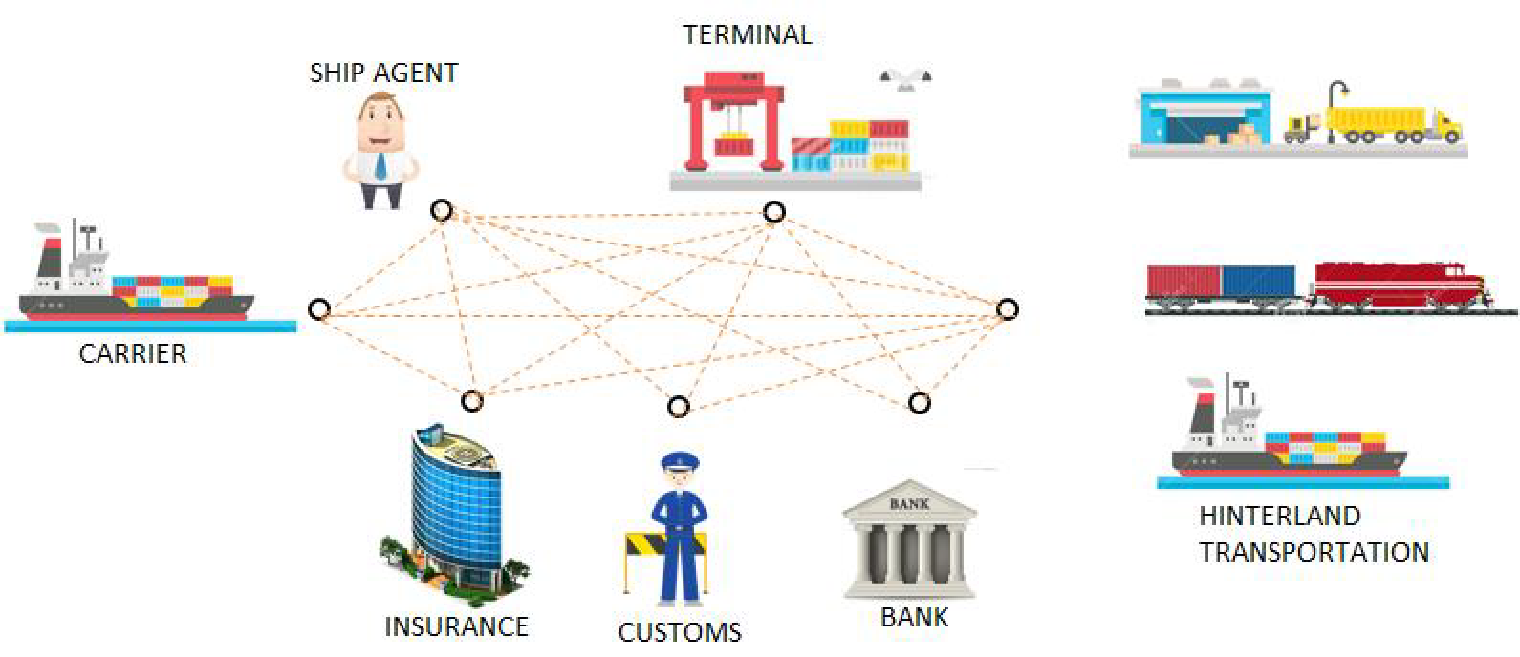

The blockchain comprises an enormous database running across a global network of independent computers that are collaboratively maintained by distributed participants. The main difference with data exchange methods is that in Blcokcahin there is no unit in the supply chain creating “islands of data”.( See Fig.4 & 5).

Figure 4. Current data exchange in the carrier process

Opposite to the “islands of data”, the Blockchain is structured on a decentralized and distributed nature, that continuously validate each transaction between all parties and sequentially record those in public “blocks”. The created reference codes allow each node in the network to have access to the transactions to which they are authorized to refer. (See Fig.5). Based on its typical natures, the blockchain features can provide added value to port logistics and port digitalization. It is about to establishing trust, secured data provision, visibility, networking, and integration of supply chain elements and actors.

Figure 5. Blockchain typical information flow in the carrier process.

The blockchain technology is expected to support both the port services and logistics while enhances the efficiency of the supply chain process. However, there are challenges for the implementation of Blockchain such as logistics stakeholders awareness on the benefits of blockchain technology. Furthermore, a blockchain IT system must be clearly understood prior to its implementation in port and logistics entities.

For this purpose, the port authorities are key players. They can play a role as facilitator to boost a specific network. They may also provide a situation to bring stakeholders together while taking on a managerial and coordinating role in the integration of different Blockchain applications. By paving the way for the transition path for companies and logistics actors, they will contribute to the digitalized future of the ports.

Authors: R. Karimpour, M.Karimpour

rter incentives to meet the International Maritime Organisation’s greenhouse gas (GHG) targets for the shipping sector

rter incentives to meet the International Maritime Organisation’s greenhouse gas (GHG) targets for the shipping sector