The infrastructure investment needs and financing challenges of European ports was the presentation theme that was given by PortEconomics co-director Peter de Langen during the ESPO2018 conference that held in Rotterdam in 30/06-01/07.

The presentation was the results the results of a study co-authored with Martina Fontanet, Mateu Turróa and Jordi Caballé and which revealed that the investment needs of EU ports that are driven by external develop, create economic value as well as societal value while Peter also gave emphasis to the funding gap.

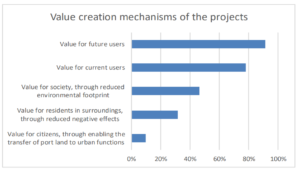

Investments in port infrastructure create economic value as well as societal value

The funding challenge: bridging the funding gap

• The best method to bridge the funding gap is an EU wide competitive funding mechanism for port managing bodies, as this prevents major distortions of the playing field and places investment initiative as well as a healthy part of the risks with the port managing body.

• The case for public funding of port infrastructure is reflected in the development of EU funding and financing instruments (CEF, EFSI, EIB).

• Between 2014 and 2017, ports have requested 2,5 €billion and were granted 860 €million (35%) The 860 €million represents 4% of the EU funding between 2014 and 2017.

• The development of port managing bodies towards autonomous, commercially operating and self-financing organisations enable a greater use of blended financing instruments. This reduces the risks associated with providing grants alone, such as overly optimistic

• Nevertheless, grants remain a key element in securing that investments that create value for society can be made.

Source: PortEconomics